Top five aluminium scrap exporting countries in the world

Top five aluminium scrap exporting countries in the world

We are all aware of the infinite recycling properties of aluminium.

Recycling aluminium requires about 95% less energy than the production of primary aluminium.

Aluminium scrap remains a significant resource to be used as raw material to produce secondary aluminum and subsequently new aluminum products.

Aluminium scrap can be both “new” and “old” scrap.

New scrap is generated from aluminum wrought and cast products as the metal is processed by fabricators into consumer or industrial products.

Old scrap is retrieved from end-of-life products or discarded products of all types. Another relatively less important source of secondary aluminum raw material source is dross.

The highest recycling percentages can be seen in the construction and transport sector of up to 95% but packaging sector is equally growing due to increased use of foil and cans.

It is evident that the countries with higher aluminium consumption would be the countries that would also be largest generator of scrap.

Not all countries export their scraps; a large portion of it is recovered domestically to make new aluminium.

Since packaging and automotive scraps are recycled and recovered faster, the following countries with more aluminium consumption in these sectors remain the top exporters of scrap.

• United States

• Germany

• United Kingdom

• France

• Saudi Arabia

United States

More than 36% of United States’s aluminium metal supply is from recycled metal, and the region is the world’s most resource-abundant secondary recovery site because of its long history of aluminium production and consumption.

In addition to scrap collected and recycled for producing secondary aluminium for domestic use, nearly 2 million tons of scrap is exported each year, representing one-third of the total global scrap supply.

Without scrap recovery the capacity of US aluminium industry would be curtailed drastically as the country has already shut down about 75% of the total primary capacity.

Meanwhile, for the USA, the world’s largest aluminium scrap exporter, global scrap shipments were down 12.3% year-on-year IN 2015 as reported by Metal Bulletin.

According to the recent analysis by WorldCity of the latest U.S. Census Bureau data, U.S. exports of aluminium waste and scrap decreased 23% from $2.35 billion to $1.81 billion in 2016 in comparison to 2015.

This is because, after the fall out of primary aluminium industry the U.S. is concentrating more on scrap generation and recovery to produce secondary aluminium.

Omni Source Corp., Sims Metal Management, David J. Joseph Co., Commecial Metals Co. are some of the biggest aluminium scraps suppliers in the US.

Germany

Europe accounts for more than 15% of global aluminium consumption and Europe’s major aluminium market is Germany, which is home to the world’s largest automakers.

Germany contributes 25% of total aluminium consumption in Europe, and the development of the global aluminium industry depends significantly on this market.

Germany’s automotive industry has a high growth potential as it exports cars all over the world catering to the increasing consumption of automotive vehicles.

German aluminium producers and processors produce about 560,000 tonnes of aluminium.

It comprises about 260,000 tonnes of primary aluminium and 300,000 tonnes of recycled aluminium.

The aluminium rolling mills account for the largest share of aluminium semis production and the largest customers for rolled aluminium semis are the automotive industry along with packaging and industrial applications.

These sectors put together, account for almost three fourth of the total rolled products demand.

The automotive industry generates a large amount of aluminium scrap.

Other than recovering secondary aluminium from the scrap domestically, the country also exports about 1 million tons of scrap every year.

WMR Recycling, Harita Metals Co, ScholzAlu Stockach GmbH, TSR Recycling GmbH & Co. KG are some of the major scrap suppliers in Germany.

UK

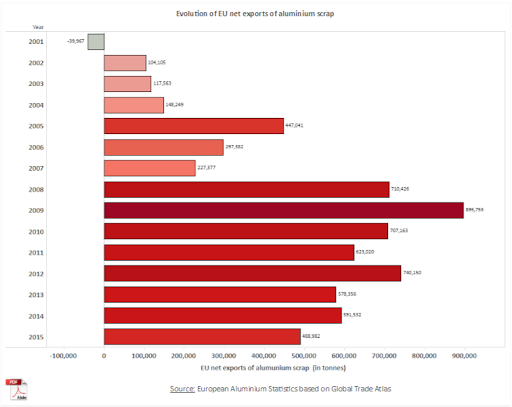

Since 2002, EU has been a continuous net exporter of aluminium scrap year-on-year.

On the flip side, high export levels of scrap compromises the development of the recycling industry and the circular economy in Europe.

More than 80% of this scrap generated in European Union heads to Asia, with 37% destined for China and 28% to India.

The aluminium scrap generated in the UK is more than the needs of the UK foundry industry.

The secondary refiners have therefore developed export markets for their products.

There is also a considerable export of aluminium scrap, particularly to China.

The remelters are usually connected with the integrated, global aluminium companies and most of the production of rolling slab and extrusion billet is used within their own supply chain.

United Kingdom exports about 514,762 tons of scrap annually.

The annual production of primary metal in the UK is approximately 200,000 tonnes and more than double the amount is recovered from recycling aluminium scrap and the extra scrap is exported for recycling in other countries.

France

France is one of the key growth markets in European aluminium industry which grew by 2.4% year on year.

The country’s aluminium consumption is driven by packaging, building and the automotive sector.

The average European car now contains over 130 kgs of aluminium, (about 10% of the weight), and this level is increasing which also boosts the amount of end-of-life aluminium scrap generation from the automotive sector.

In the same way packaging and building and construction segment generates substantial amount of scrap.

France exports about 400,000 tons of aluminium scrap every year.

Recently, the aluminium scrap export has seen a decline in France. Many scrap dealers in France have reported more than adequate stock levels.

A boost in domestic recycling effort can be more productive for the European countries including France.

Saudi Arabia

The Middle East and the GCC is one of the fastest growing aluminium markets in the world.

The aluminium recycling market is predominantly export-driven as the downstream industry is yet to develop as a major scrap procurer in the region.

The Middle East has a nominal rate of 20 per cent aluminium recycling including smelter re-melting, scrap generation, and secondary re-melting.

The major hurdle in the Middle East Aluminium Scrap Market, which result in low rate of recycling is the lack of development of downstream industry.

As per Frost & Sullivan estimates, the total Aluminium Scrap generated in the Middle East is estimated to be about 500,000 tons, of which about 360,000 tons are exported to international market destinations.

The Kingdom of Saudi Arabia (KSA) is a major hub for scrap metal recycling followed by the United Arab Emirates (UAE) in the Middle East.

Most of the aluminium scraps generated in Saudi Arabia are from consumers, industries, and demolition sites across the country.

The country exports about 210,000 tons of aluminium scraps to countries like India, Pakistan, South Korea, Brazil and USA.

With the development of new smelters and expansions, more secondary re-melting opportunities will arise in the GCC countries and till then Saudi Arabia would remain a net exporter of aluminium scrap.

Summing Up

According to a report from Metal Bulletin, scrap flows have slowed year over year, with net trade figures for most countries showing lower volumes year-to-date in 2015 than 2014.

This is true not just for aluminium scrap but across the non-ferrous scrap industry.

And it is less the result of reluctance by sellers to offload material at this year’s lower prices, and more to do with a hesitation among buyers to purchase.

According to The Bureau of International Recycling (BIR), the majority of non-ferrous metal markets including copper, aluminum and zinc have reached a level of saturation, mainly on account of high prices towards end-2016.

However, with the changing market situation in 2017, the market is expected to move.

However, with more emphasis on a circular economy, it is expected that aluminium scrap export will stay low and domestic scrap recovery would be more encouraged in the European countries.

From Alcircle